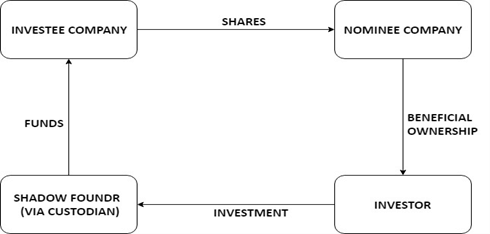

Investors’ shares are held in safe custody by a nominee company which acts as the legally registered owner of the Company’s shares. While the nominee company holds the shares, the full economic benefits of the shares are passed onto the underlying investor, including the benefits of individual tax reliefs such as SEIS and EIS (the nominee arrangement is very similar to a trustee relationship).

Shadow Foundr is pleased to be able to offer the share nominee account (the “Nominee”), especially as the majority of platforms and fundraisers in the industry are either insisting on operating fully the share nominee account or are having to move towards it. When it comes to company decisions Shadow Foundr will keep the shareholder updated on any corporate actions notified to it by the Company in line with the Company Articles of Association and/or the Shareholder’s (Subscription) Agreement.

- As an investor, you will understand the difficulties associated with remaining in contact with the start-up or early stage company you’re investing money into.

- For the investor, there can be miscommunication, it can be hard to maintain voting rights, and there are often no investor protections.

- The nominee share account is a method of dealing with all of this. In the nominee share account, the investors’ shares are held in safe custody by a Nominee Company.

Frequently Asked Questions:

What are the benefits for the Nominee Share Account for the investor?

- The Nominee reduces the administrative burden and is responsible for communicating all corporate actions (that need consents or voting) between the investors and the Company, and while the nominee company is the legally registered shareholder in the Company’s shareholder register, the investor is the beneficial owner and maintains all the shareholder rights and the tax advantages of SEIS and/or EIS, if applicable.

- The Nominee facilitates follow-on funding, as institutional funders including many Venture Capital firms (VC’s) do not like dealing with busy Share Capital Tables and numerous minority shareholders, which tends to put them off investing. Instead they prefer to deal exclusively and directly with a Nominee.

- It also considerably aids liquidity for the investor, as providing secondary markets or transferring shares is far easier within a share nominee account (as there is no change of the legally registered owner of the shares, but an internal transfer of beneficial owner within the Nominee) and indeed when it comes to that all important Company exit (e.g. a trade sale or IPO).

Do investors receive Share Certificates in the share nominee account?

No, only the nominee company receives a share certificate as the sole legally registered owner of the shares (and it is the name that appears in the share register and on Companies House). Many companies do however send a “Confirmation of Beneficial Ownership” to their shareholders.

Who does Shadow Foundr use for their share nominee account?

Shadow Foundr uses an independent custodian, Logic Investments Limited (“LI”), a limited company with Registration Number: 07092136 (“LI”) which is fully authorised and regulated by the FCA (FRN: 516459), with the Company’s shares being held in Logic Nominees Limited – a non-operating holding company, in order to ring-fence the shareholders’ assets from normal every day operating activities. Shadow Foundr acts as an arranger between the businesses and the nominee company on the investor’s behalf.

What sort of confirmation will the investors of the Company get from the nominee?

Investors can see their shareholding via the Shadow Foundr platform and download a confirmation from the platform, while a statement from the Nominee demonstrating that you are the beneficial owner of the Company’s shares, on request. The investor should also have access to a copy of the up-to-date Company Articles of Association and/or Shareholder’s (Subscription) Agreement.

Who then sends out regular Company updates?

The Company is still obliged to keep its investors updated regularly on the progress of the Company. When the Nominee is notified by the Company, it will send out corporate actions (such as consents or shareholder votes) to the investors as the beneficial owners of the Company’s shares.

Does the nominee company arrange the SEIS or EIS Tax Certificates for investors?

No, the advisers or the Company’s accountants still need to arrange the SEIS and EIS Tax Certificates as is required by the HMRC. However, holding shares in the Nominee does not affect the investor’s entitlement to such benefits.

Summary

For the start-up business or early stage company the burden of administration is reduced, however the nominee share account also has many advantages for the investor:

- When there are a multitude of investors, the Nominee helps to protect the individual shareholder and helps to ensure that minority investors are represented when consents and votes are conducted in line with the Company’s Articles of Association.

- The Nominee makes it easier for the business to manage corporate activities such as a merger, selling out to a trade buyer, VC investment or listing the Company on a stock exchange; thereby helping the Company to facilitate the investor’s all important exit strategy.

- The Nominee makes the process of selling and transferring an investor’s shares much easier which is important, not only for the exit strategy, but also for the opportunity to facilitate a secondary market in the Company’s shares (something Shadow Foundr is keen to promote wherever possible).

- Shadow Foundr is pleased to be able to offer the share nominee account, in common now with all major Investment platforms (many of which insist on the exclusive use of the Nominee) and is keen to exploit the benefits the nominee account brings for both investors and entrepreneurs.

- For those who are not familiar with the share nominee account, it is important to stress that investors are still the beneficial owner of the shares. Their shareholder rights are protected and the investor maintains all their SEIS and EIS tax advantages, if applicable.